Car Leasing Done Right - The Book

View book details on Amazon.ca or Download First 4 Chapters

Book Review from The Rational Reminder Podcast

Author Appearance at The Money with Katie Show

Printed & Kindle version Available at Amazon

You will learn to easily understand the numbers. How to sign a contract that gives you peace of mind. How to transfer your lease without affecting your credit. You will learn the right way of leasing a car you can afford without hurting your finances. And many more other tips for your insurance, warranty, saving money and time.

15 Years of Data, Insights and Money Saving Tips

It took more than 15 years to gather all the information provided in this book. It is a guide that will help anyone to confidently sign and satisfy his/her transportation needs with a lease contract. You will also know how much Canadians spend on their car lease, down payment, the average term, the cash incentive the offer...

IMPORTANT NOTICE: Here you will find an extract of one of the most important sections of the book "Car Leasing Done Right". Following is part of Chapter 8: The Right way of Leasing a Car.

The 5 most important Car Leasing tips

Not only that, but where risk is reduced to a minimum, and where each payment goes toward guaranteeing you 100% reliability, even in the worst-case scenario of a breakdown.

To guarantee all this, you need to make sure of the following five things::

- The warranty coverage ends with the term: every single day of your lease contract should be covered by a manufacturer warranty. It is a must. Fixing mechanical problems on someone else’s car is not a situation you should be involved in with a leased car. If it is a 60-month lease and the warranty expires on the 3rd year, then add an extended warranty to cover the last 24 months.

- You have wear & tear coverage included: this is also a must. You need a car to enjoy, to feel free, and to have fun every day. You should not have to worry if one of your kids scratched a seat or there is a small dent you’ll have to pay for in 3 years. Never take a leased car without this wear & tear coverage.

- The km allowance is set slightly above what you expect to need: this may be tricky to estimate, but the best way to make it work is by going above what you expect your km to be. If you expect to drive around 20,000 km per year, paying an extra $15/month will bump you up to 24,000 (on average). This will guarantee you peace of mind for years to come. The same goes if you expect to be near 16,000 km. Then go for the 20,000 km.

- Your payment is aligned with the MSRP - residual value: make sure you do your math. You will pay some interest, for sure. But knowing the MSRP and the residual value will help you quickly calculate how much you are paying. Believe it or not, salespeople enjoy making deals with educated customers who talk clearly about what they want and understand where each number comes from. The less people know about the numbers, the more they feel “tricked,” although this is not the goal of salespeople. We are in a century where customer retention and value delivery are more important than getting an extra commission on a sale.

- Do not make a down payment unless it is necessary: always remember this – “if the car gets stolen on Day 1, you will lose the down payment.” Limit your cash down only to something you are willing to lose or, if you expect to potentially sell it before the end of the lease. Still, once you get to Part Three of this book, you’ll get a better idea of how much Canadians do put down and the average amount down per car manufacturer. (...)

#1 – Your auto insurance.

#2 – The best time of the month to buy.

#3 – Take good care of your credit score.

#4 – Accessories and winter tires.

You can find the full index and the first two chapters in the Preview section at Amazon.ca:

View book details on Amazon.ca or Download First 4 Chapters

Also in the Book:

15 Years of Data, Insights and Money Saving Tips

It took more than 15 years to gather all the information provided in this book. It is a guide that will help Canadians confidently sign and satisfy their transportation needs with a lease contract. You will also know how much your peers spend on their car lease, down payment, the average term, the cash incentive the offer...

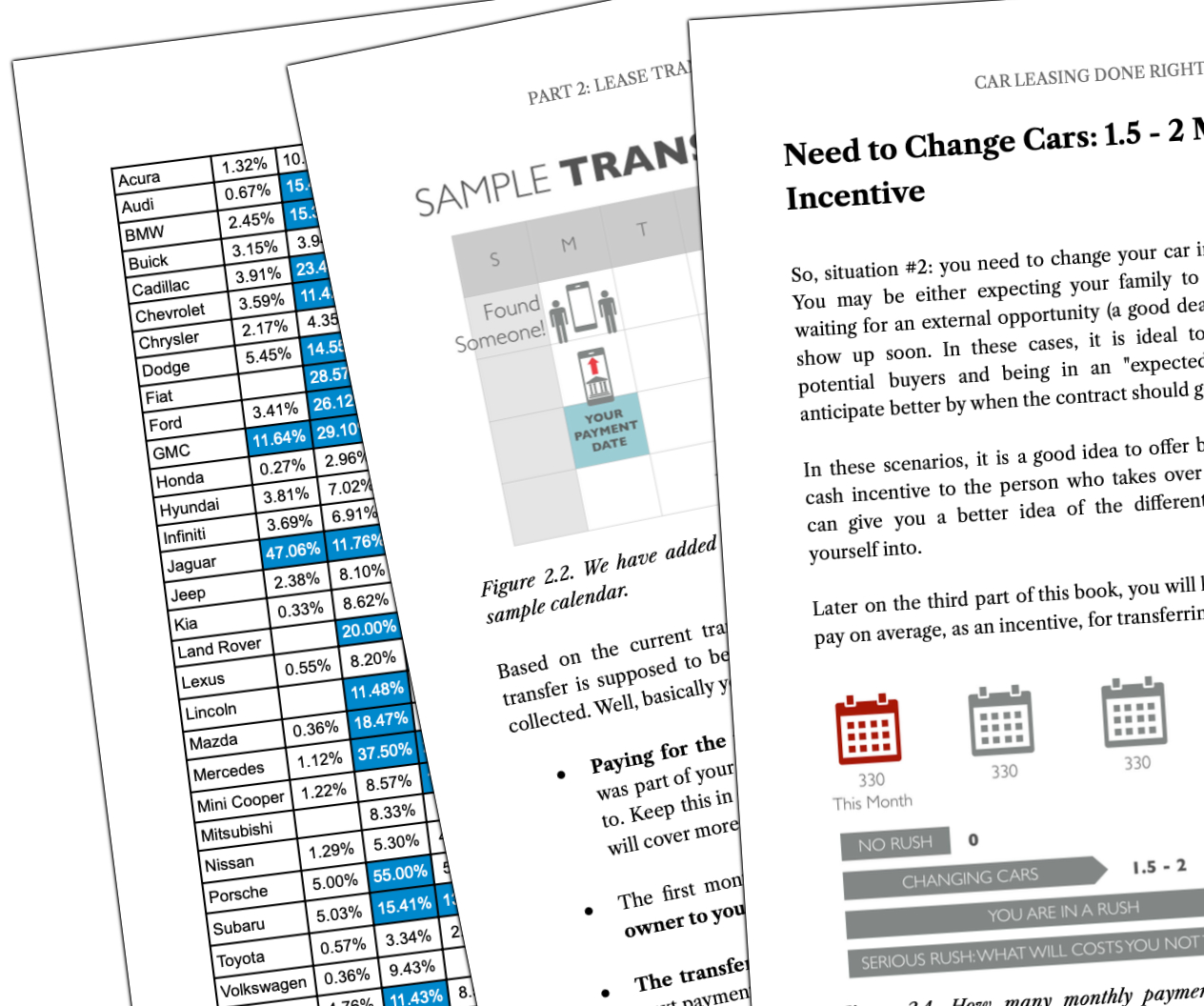

Here is a sample of one of the more than 20 charts included in the book: Car lease monthly payment average for Mass Market brands in Canada.

You will be able to benchmark yourself and even anticipate what dealerships expect from their customers – and what customers expect from them.

Also, once you get to know most of these exclusive stats you will feel more confident, because you’ll understand from the very beginning if “leasing” is an actual cost-effective solution for you. You’ll also be able to go after that lease the right way from the very beginning.

The matrix of questions you will be able to answer by yourself will be wide, but to mention a few, these will include:

- How much do Canadians pay per month on average on a car lease?

- What is this average for each specific car make?

- What are the most popular leasing terms by manufacturer?

- What is the average down payment? How much is it for Volkswagen, Audi, KIA ...? How many people make a down payment?

- How many people actually take the coverage and how can it impact my future?

- What does the market expect as an acceptable cash incentive for transferring a lease? (...)

To your success,

Jorge Diaz

Author of "Car Leasing Done Right" | CEO and Founder at LeaseCosts™ Canada Inc.